Personal pensions are given by life cycle, such as 55 and 60 years old, so you can live in your old age. Today, we will learn about the basic old-age pension among pensions. The elderly people around me are already receiving it.Thanks to the basic old-age pension, you are enjoying a comfortable retirement life.That’s a good system.

기초노령연금

basic old-age pension

Basic Old Age Pension eligibility – 65 National Pension

The basic old-age pension is a pension that must be 65 years of age or older.Other pensions are often 60 years old.It’s not a pension that you can get all of just because you’re 65 years old or older.Only those who are eligible for the pension can receive the pension.The basic pension is a system to help the elderly who are having a difficult retirement. The basic old-age pension has been established since 1988 to help those who have tried for national development and children’s education, but the basic pension system

has been established to help the elderly live in old age because they do not have enough pension.

1. Eligibility to be eligible

Let’s take a look at the qualifications for the basic old-age pension in earnest.

subject

basic pension eligibility

The basic pension will be given to senior citizens aged 65 or older, who have Korean nationality, and who reside in Korea (resident registrants pursuant to Articles 6 and 2 of the Resident Registration Act) whose household income is below the selection standard.

*If only one of the couple applies, it is also a couple household.

2022 Selection Criteria – Classification, Single Households, Couple Households

Sortation single-family household married couple’s

selection base amount 1,800,000 won. 2,880,000 won.

– The recognized income is the sum of the monthly income valuation and the monthly income conversion of property.

– Public Officials Pension, Private School Teachers Pension, Military Pension, Special Post Office Pension recipients and their spouses are, in principle, excluded from the basic pension.

The eligibility is…

1. Must be 65 years of age or older.

2. You must have Korean nationality and live in Korea.

3. Among the elderly, the income recognition amount of the household must be less than or equal to the selection criteria.

The standard amount for selection is 1.8 million won for single households and 2.88 million won for married households.

In the above eligibility, the income recognition amount is calculated as follows.

3. Method of calculating the recognized income

* The recognized income amount is calculated in the following manner:

Income recognition amount = Income evaluation amount + + income conversion amount of property 소득.

소득Evaluation of income = { 0.7 * (earned income – 1.03 million won)} +

calculate with other income.A: We will deduct an additional 30% from the basic deduction of 1.03 million won from earned income.Daily earned income, public job income, and self-support earned income are excluded from earned income.

B: Other income: Business income, property income, public transfer income, free rental income

[Business income]

sum of other business income and rental income

– Other business income: income from wholesale, retail, manufacturing, agriculture, fisheries, forestry, and other businesses

– Rental income: Income arising from the rental of real estate, movable property, rights, and other property

[Property income]

sum of interest income and pension income

-Interest income: Income generated by interest and dividends or discounts on deposits, installment savings, stocks, and bonds

-Pension income: Income generated regularly by private pension insurance and pension savings

[Official transfer income]

– various allowances, pensions, salaries, and other money and valuables regularly paid according to the provisions of various laws and regulations

(National pension, civil service pension, military pension, private school faculty pension, industrial accident benefit)

* However, the money received as a lump sum is calculated as property.

[Free rental income]

– Amount recognized as income equivalent to the rent for the principal or spouse residing in a high-priced house owned by the child;

– If the residential address of the person or spouse is in the name of the child and the market price is more than 600 million won, an annual income of 0.78% will be applied.

*Example of free rental income

above-mentioned

A is an additional 30% deduction from the basic deduction of 1.03 million won from earned income.

Self-support earned income, daily earned income, and public job income are excluded from earned income.

above-mentioned

B’s other income can be regarded as income including all free rental income//public transfer income//property income//business income.

business income is

The sum of rental income and other business income.

property income is

The sum of pension income and interest income.

public transfer income

It refers to various allowances//pension//salary//other money and valuables that are regularly paid according to various laws and regulations.

free rental income is

The amount recognized as income corresponding to the rent for yourself or your spouse living in a high-priced house owned by your child, and 0.78 percent per year will be applied if your spouse’s residential address is in the name of your child and the standard market price is more than 600 million won.

4. Calculation of basic pension amount (basic pension amount)

The basic pension amount of those who fall under the following is calculated as the base pension amount*.

*Jan 2022 to Dec 2022: Up to 307,500 won per month

Let’s look at the calculation of the basic old-age pension and the amount received.

1. Those

who are not receiving the National Pension Service 2. Those

who

are receiving the National Pension Service’s survivor’s pension or disability pension 4. Those who

are receiving

the National Basic Livelihood Protection or disability pension are

calculated as the base pension.It costs up to 307,500 won per month.

*Note If

the income level is relatively high and both couples are eligible for the basic pension, it may be reduced.

If it does not fall under 1 to 4 above, the basic pension amount will be calculated in another way.

5. Calculation of the amount of basic pension (including income redistribution

The basic pension amount of those who do not fall under the above case is calculated in consideration of [the formula according to income redistribution benefit (A benefit)] or [the amount of national pension benefit].

Equation according to income redistribution = [Basic Pension Amount – 2/3] × A salary] + additional pension amount

If the result of the calculation in parentheses is negative, treat it as “0”

What is income redistribution benefit (A benefit)?

1. National Pension Benefit Increase The basic pension characteristic is the standard for determining the basic pension amount for each individual.

2. The longer the subscription period and the earlier the subscription, the higher the A salary.

3. Even if the subscription period is the same, the amount of A salary varies depending on the timing of the subscription and the subscription history.

5. Calculation of the basic pension amount (National Pension Service Amount

national pension benefits

Sortation January 22nd ~ December 22nd Remarks

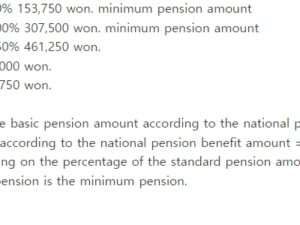

base pension amount of 10% 30,750 won. minimum pension amount

base pension amount of 50% 153,750 won. minimum pension amount

base pension amount of 100% 307,500 won. minimum pension amount

base pension amount of 150% 461,250 won.

base pension of 200% 615,000 won.

base pension of 250% 768,750 won.

This is the calculation of the basic pension amount according to the national pension benefit.

The basic pension amount according to the national pension benefit amount = 250% of the base pension amount – the national pension benefit amount, etc. * is calculated.

The amount varies depending on the percentage of the standard pension amount shown in the table.

10% to 100% of the base pension is the minimum pension.

. the pension is . 6. When the basic pension is reduced

It can be reduced depending on the type of household and the amount of income recognized.

Couples’ reductions: 20% each for both of them receiving basic old age pensions.

Reduction of income reversal prevention: To minimize income reversal between basic pension recipients and non-beneficiary.

{Income recognized amount + basic pension amount (for households with two couples, after couple reduction)}- Selection Criteria

We looked at the basic old-age pension and eligibility.

Those who qualify will receive good benefits.