The deduction for youth employees tomorrow is a deduction that jointly accumulates deductions by young workers in small and medium-sized business owners in the form of performance compensation to young workers who have worked for a long time according to the subscription

Subjects and Steps for Young Employees to Subscribe to Tomorrow’s Filling Deduction

It is a deduction jointly accumulated by full-time workers aged 15 to 34 years or less for young workers in small and medium-sized business owners, who have been working for more than six months, in the form of performance compensation.Those who have served in the military can apply by linking age in proportion to the service period, and the maximum age can be applied up to 39 years old.Representatives, family relations, spouses, lineal descendants, etc. cannot join.In addition, it will be excluded if you are signing up for twice the number of young people who want to do business with asset formation support under the government.Of course, this system is not compulsory, so it is possible only when companies apply for a full deduction system for young employees tomorrow.

STEP1 Employment STEP2 Accumulation

(Corporate + Youth Workers + Government) Step 3 Compensation

(Full-time 5-year maturity) STEP 4 growth

It is a system in which the government of young companies accumulates support and forms an asset of 30 million won when they serve as regular workers for five years.Young people will be accumulated 7.2 million won for five years, at least 120,000 won per month for 60 months.As for the payment method, the young worker himself or herself can choose between the 5th, 15th, and 25th of each month from the commercial bank account under the name of a young worker set in advance and set the automatic transfer.The company will set aside 12 million won for five years, at least 200,000 won per month for 60 months.The payment method is automatically transferred from a pre-set commercial bank account under the name of a small and medium-sized company on the 5th, 15th, and 25th of each month.Tax benefits young people will be reduced by 50% of earned income tax on corporate payments, and companies will be reduced by 25% of the total amount of deductible expenses and tax deductions will be reduced by 25%.The government will set aside 10.8 million won over three years and set aside seven times over three years.The accumulation method is accumulated in the performance compensation fund for 36 months over 16 12 18 24 30 for three years.Young workers’ offensive payment wages or contributions to small and medium-sized enterprises can be paid by the following differential accumulation method, but changes between the flat-rate accumulation method and the differential accumulation method cannot be adjusted annually.

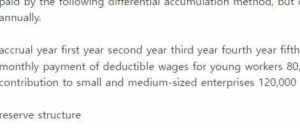

accrual year first year second year third year fourth year fifth year

monthly payment of deductible wages for young workers 80,000 won. 100 thousand won 120,000 won. 140 thousand won 160,000 won.

contribution to small and medium-sized enterprises 120,000 won. one hundred and fifty thousand won 200 thousand won 25 million won 280,000 won.

reserve structure

subtotal One month six months 12 months eighteen months twenty-four months thirty months 36 months. sixty months

main payment 7.2 million won. 1260 months per month = 7.2 million won.

corporate payment 12 million won. twenty times a month60 months = 12 million won.

government support 10.8 million won. 1.2 million won. 1.2 million won. 1.5 million won. 1.5 million won. 1.8 million won. 1.8 million won. 1.8 million won. –

Refund Payment Criteria for Cancellation of termination

According to the terms and conditions of deduction for youth employees tomorrow, if the contract is terminated within 12 months from the date of establishment, the government subsidy and interest for the period will be returned to the government.

refund for termination

Matters to be paid in the middle of termination When attributable to SMEs, both deductible and government subsidies are received by young workers.When attributable to young workers, contributions to small and medium-sized enterprises are received by companies, and government subsidies are received by young workers.Check out the table for cancellation refunds according to the reasons attributable to it.Among them, government subsidies will be returned to the government as young workers are terminated due to illegal activities such as illegal supply and demand among the reasons attributable to them.