Hello, this is Ernie who shares financial information. 카오뱅크 비상금대출 연장

In this post, we will share more about the overall reviews, including interest calculation, extension and repayment methods, limits, and the impact on credit scores of Kakao Bank emergency loans.

We will look at each one in order, and we will also organize the questions we often ask at the end.

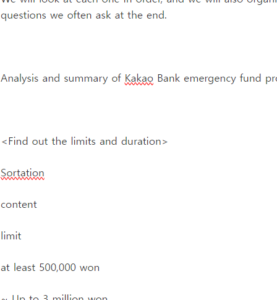

Analysis and summary of Kakao Bank emergency fund products!

<Find out the limits and duration>

Sortation

content

limit

at least 500,000 won

~ Up to 3 million won

1 year

▶ Up to 3 million won may vary from person to person depending on the credit score you evaluate.

▶ In the case of extension of the period, applications are required through the pre-maturity app and can be extended every year depending on the results of the review.

▶ Please note that the conditions applied may vary depending on the time of extension.

<Find out the applicable interest rate>

Let’s find out the information for each type of standard/additional/preferential treatment.

kind

content

Criteria

3.961% per annum (one year of financial bonds)

Additional amount

1.223% to 11.039% per annum

preferential treatment

0.100% p per annum

▶ The additional interest rate is given differently depending on the individual’s credit score and debt status.

▶ The one-year linkage of financial bonds changes every year, so it does not change during the loan period after the first subscription, but may change in conjunction with the base interest rate as the fluctuation cycle arrives.

▶ Please note that the preferential condition of 0.100%p is automatically applied when agreeing to provide financial transaction information.

< Find out overdue information>

overdue period

content

in arrears

Applicable interest rate + 3% per annum

▶ The maximum rate of delinquent interest rates is up to 15% per year, and if it is already 15% or more per year, +2% will be applied.

Kakao Bank Interest and Redemption Method Summary!

<How to redeem>

a temporary repayment due

▶ It can be paid back or reused from time to time within the limit, and if you do not apply for an extension of the deadline, all remaining balances and unpaid payments will be repaid on the maturity date.

It is an exemption from the interim repayment cancellation fee and does not incur additional costs.

<Example calculation>

① For example, / 3 million won / 1 year / Minimum of 5.09% is applied

▶ Since it is a temporary maturity repayment method, you only need to pay interest every month for one year, but assuming that you have used up all 3 million won, the total amount of interest to be paid for one year is 152,700 won.

② The following conditions are / 3 million won / 1 year / up to 15%

▶ When you apply up to 15% interest rates, the total expected interest you will pay for one year is 450,000 won.

Check the precautions

Please note that the product is a negative bankbook method, so just because you are given 3 million won, you don’t pay all the interest on it, but only as much as you use it.

Precautions and frequently asked questions

<Find out the conditions you are eligible to join>

Regardless of job or income, it is possible if you meet all of the following criteria.

▶ I am a Korean over 19 years old.

▶ Subjects with no history of holding or causing losses to Kakao Bank

▶ Objects without facts such as financial fraud, bankruptcy information, rehabilitation bankruptcy, etc

▶ Customers who can issue insurance policies for Seoul Guarantee Insurance Co., Ltd

This part is not registered separately, but is issued by direct information when applying for a product. In addition, the guarantee limit is applied differently depending on the individual, so you need to apply to know.

< Frequently asked questions>

Q. Will it affect your credit score?

Kakao Bank is the No. 1 financial sector, and just new things from this bank will not have a significant impact on the decline in credit scores.

However, please note that the impact on individuals may vary depending on the current credit score and debt status.

<How to sign up>

If you apply, please check the use or the size of planned assets as shown in the picture after consent, and refer to the order below.

Previous imageNext image

First, run the CarBang app, then click on the bottom right three dots > screen and press the emergency loan category to go to the application page.

Let’s clean up

< Compare more information >

If you have been rejected for approval, have a small amount of money to receive, or are burdened by various factors, please refer to the article comparing five banks, and I hope it will help you choose the best emergency payment product for you.

5 Unemployed Emergency Money Loans Conditions Comparison Carbank Woori Toss One

5 Unemployed Emergency Money Loan Banks Conditions/Rates/Limits General Summary! Hello. Sharing useful information…

blog.naver.com

And those who want to receive useful financial and economic policy information in their daily lives, or have similar interests, are more welcome to neighbors and neighbors 🙂